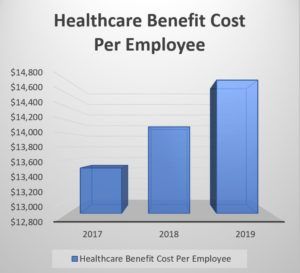

Employers can expect to pay almost $15,000 per employee for healthcare benefits in 2019, according to the National Business Group on Health’s Large Employers’ 2019 Health Care Strategy and Plan Design Survey. The 2019 costs are 5% higher than in 2018. The survey also revealed how highly motivated employers are to reel in those costs. Many are putting pressure on their commercial health plans to implement ACOs and alternative payment models, while others are contracting directly with providers.

Payors have already been exerting pressure on medical practices through reduced reimbursement rates, physician tiering, and narrowing networks. With these new findings, it’s safe to say that physicians won’t be getting relief anytime soon.

Narrowing Networks

Both commercial payors and large self-insured employers are looking for the most efficient way to give their members access to the care they need. Contracting with hundreds of individual providers is a drain on their internal resources, therefore, they have begun narrowing their networks to include fewer, larger groups.

Even when independent practices remain in-network, their negotiating power is diminished. The size of a practice’s market share oftentimes determines the size of its reimbursement rates. Practices that are affiliated with a larger organization can leverage that scale to negotiate better terms with payors who recognize what larger groups can offer them. For example, QualDerm has been able to negotiate more favorable rates for its affiliated practices in various markets due to the breadth, geographic diversity and quality of its provider network.

Access to Care

The quest to reduce costs may bring unintended consequences. Fewer in-network options means longer wait times to get an appointment. Further, some payors are eliminating entire specialties from their networks, including dermatology. In some cases, like skin cancer, delaying or denying access to specialized care puts the patient at risk and can significantly increase the cost once the needed care is obtained.

Payors are looking for the best quality at the best price. Practices that are part of a larger organization typically have more sophisticated back-office systems that allow them to better track and report metrics like outcomes and patient satisfaction rates. QualDerm’s in-house IT team works with each of our affiliated practices to capture and analyze important quality-of-care metrics that can be used to ensure these practices are not relegated to an out-of-network status.

Practice Staff Benefits

The healthcare cost issue is a double whammy for medical practices. At the same time that their revenue is taking a hit due to payor cost containment measures, their own employee healthcare benefit expenses are skyrocketing. What’s more, smaller practices may not be able to afford to offer healthcare benefits at all, which hinders their recruitment and employee retention efforts.

As part of the QualDerm network, affiliated practices’ staff have access to several healthcare benefit options. The scale of QualDerm’s network allows us to offer comprehensive benefit packages while keeping the employees’ out-of-pocket costs more affordable.

Learn more about how partnering with QualDerm can help you protect your practice from payors’ cost-cutting pressure.

Contact us to find out more about partnership opportunities or to discuss selling your practice.