QualDerm Partners: A Skin & Aesthetics Wellness Family Dedicated to Supporting High-Quality Patient Care

A Quality-First Network for Dermatologists & Skin Care Experts Across the Continental United States

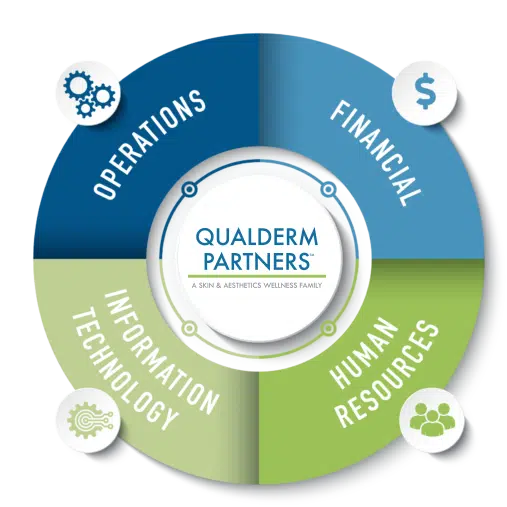

QualDerm Partners empowers top-tier dermatologists to position their practices for long-term, sustainable growth and enhanced profitability. We achieve this by fostering market-leading practice partnerships through strategic affiliations and the development of new practices (de novo). With a deep understanding of the dermatology landscape, QualDerm provides comprehensive management support, access to capital, and expert guidance to drive growth and maximize operational efficiency.

Our collaborative approach enables dermatologists to focus on delivering exceptional patient care while we handle the complexities of practice management, ensuring both immediate success and a strong foundation for future expansion.

Our Values Set Us Apart. Find Out How QualDerm Partners is Different

What to Know About QualDerm Partners

QualDerm Partners – A Skin and Aesthetics Wellness Family is an exciting brand created from combining two of the best-in-class names in skin and aesthetics care: Pinnacle Dermatology and QualDerm Partners. What hasn’t changed is our commitment to supporting high quality patient care! We remain steadfast in our dedication to patients and our goal to support a patient experience that is second to none.

QualDerm Partners supports 158 practices in 17 states, spanning across the full spectrum of dermatology, skin cancer care, cosmetics, plastic surgery, and pathology with continued plans to expand further across the nation.

We see, on average, over 120,000 patients every month and support more than 350 providers. Learn more about us here.

TRUE PARTNERSHIP

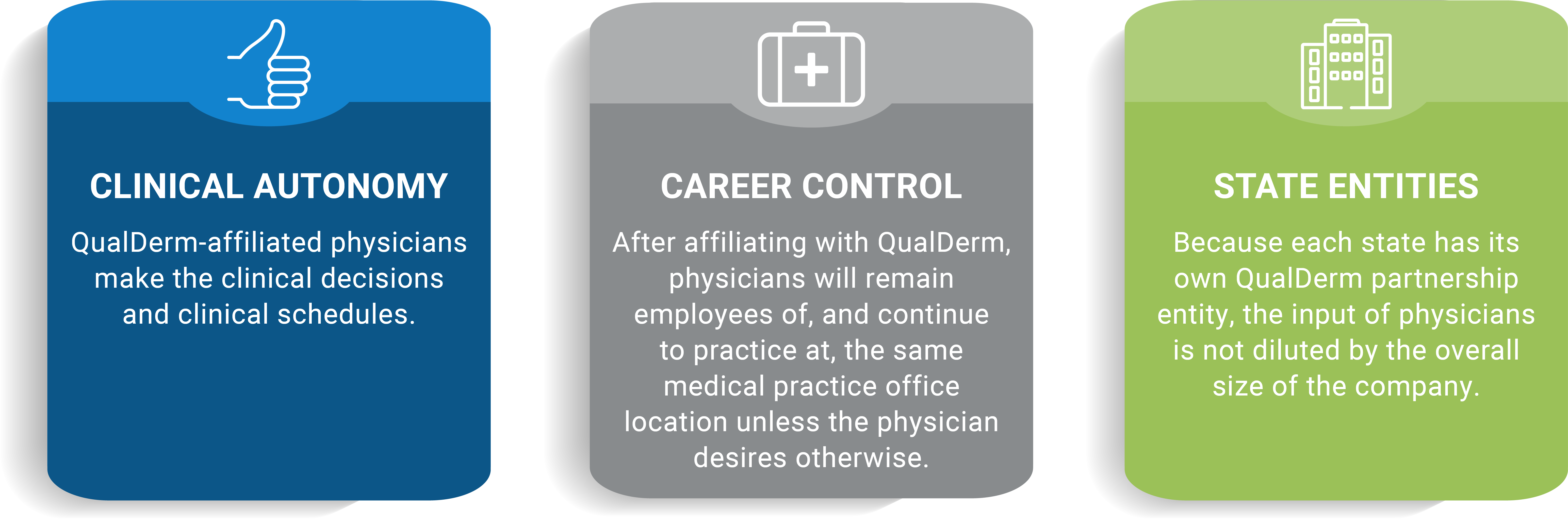

We believe that for a partnership to succeed, both sides must work together toward common goals and have a voice in decisions.

Benefits of A QualDerm Partnership: Why Should You Partner with QualDerm Partners?

Strengthen Your Position: Leverage the power of a larger network to safeguard your practice against reimbursement cuts and growing competition, ensuring financial stability and long-term success in an evolving healthcare landscape.

Accelerate Practice Growth: Access essential capital and expert guidance to expand your practice while diversifying revenue streams through innovative opportunities and new service offerings.

Collaborate with Experts: Join a distinguished network of highly experienced dermatologists and Mohs surgeons, fostering collaboration and knowledge-sharing to enhance patient care and clinical outcomes.

Simplify Practice Management: Relieve the administrative and operational burdens of running a practice, allowing you to focus on what matters most—providing exceptional care to your patients—while regaining a healthier work/life balance.

WHAT MAKES QUALDERM DIFFERENT

Our physician partners maintain their autonomy so they can continue to deliver the best patient care possible.

QualDerm Partners Providers Advancing Expertise and Innovation at Premier Dermatology Conferences

John Albertini, MD, FAAD, FACMS Discusses the QualDerm partnership

Since affiliating with QualDerm, I don't get bogged down in the day-to-day grind of running the practice. I'm happy to be working with professionals who know what needs to be done and the best way to do it. - Julie Countess, M

QualDerm's culture of quality and physician leadership was central in our decision to partner with them. - John Zitelli, MD

QualDerm is unique in its focus on the partnership aspect in its relationships with physician practices. We have felt completely supported in our resolve to protect and enhance our clinical operations. Witnessing the expertise now being deployed within our practice is both refreshing and comforting. - Barry Leshin, MD

Featured Products for Healthy Skin

Check your local office for current stock!

Check your local office for current stock!