Insurance Hassles & Financial Pressure: The Burdens of Dermatology

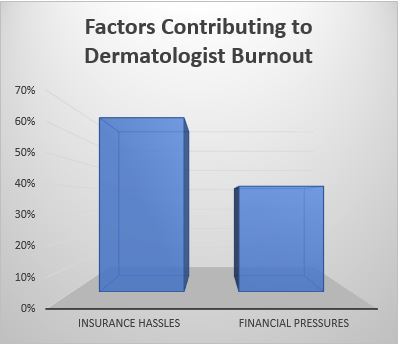

Physician burnout continues to be a much discussed topic in healthcare circles. Study after study confirms that 1) physicians are burned out; and 2) practice management burdens are largely to blame. Findings from a recent survey of 161 dermatologists were published in the January 2020 issue of Practical Dermatology. In that survey, 74% of respondents admitted to feelings of burnout, with 66% citing insurance hassles and 40% citing financial pressures as the reasons why.

Source: Practical Dermatology

Insurance Companies’ Growing Leverage

In many medical practices, insurance hassles and financial pressure are closely tied. Payors’ leverage in many markets continues to grow. In addition to shrinking reimbursement rates, dermatologists in small and solo practices must also concern themselves with how to maintain their in-network status. Practices that are part of a larger network are better positioned to negotiate with commercial insurers. For example, in North Carolina, QualDerm was able to help its affiliated practices negotiate a 7% rate increase with the market’s largest payor. Further, QualDerm’s IT team works with its affiliated practices to capture and report quality and cost data that can be used to negotiate better rates with payors.

Revenue Cycle Challenges

Even busy, high-quality dermatology practices can face financial challenges. Medical practices’ revenue cycles are long – and difficult to manage. More complex billing and coding regulations and increased payor scrutiny can lead to cash flow issues, causing physician owners to worry about making payroll.

An effective and efficient revenue cycle can significantly improve a practice’s bottom line. Average practices can increase cash flow by over 3% by enhancing their revenue cycle management. Shortening the average days in A/R and reducing payor denial rates are two examples of ways to increase revenue cycle efficiency. QualDerm works with its affiliated practices to ensure each aspect of the revenue cycle is optimized.

In Tennessee, QualDerm implemented a coding education and quarterly review program after a 3rd party audit showed numerous instances of under coding. One year after the program began, the practice’s revenue increased 29%, thanks to correct coding.

Learn more about how QualDerm can help you alleviate the insurance hassles and financial pressures associated with managing your practice.

Contact us to find out more about partnership opportunities or to discuss selling your practice.